|

Merchant Cash Advances, FASB GAAP |

Scroll down for Price Page and

free demo

MCA - Merchant Cash Advances

GAAP, FASB Software to

calculate deferral

balances.

Original discounts plus other deferred items such as

commissions, broker

fees, bank fees ....

Import a Deals File to

the software monthly or

just once a year.

Create an extract file from your servicing system in

Excel.

Supports Daily and Weekly payments.

Deals can be short term or span multiple years.

Deferral values can

be reduced by any investor syndicated %.

Payments are calculated

by the software as an average

of:

Prior month or Original Face Value minus Current month Face Value

divided by number of payment due dates.

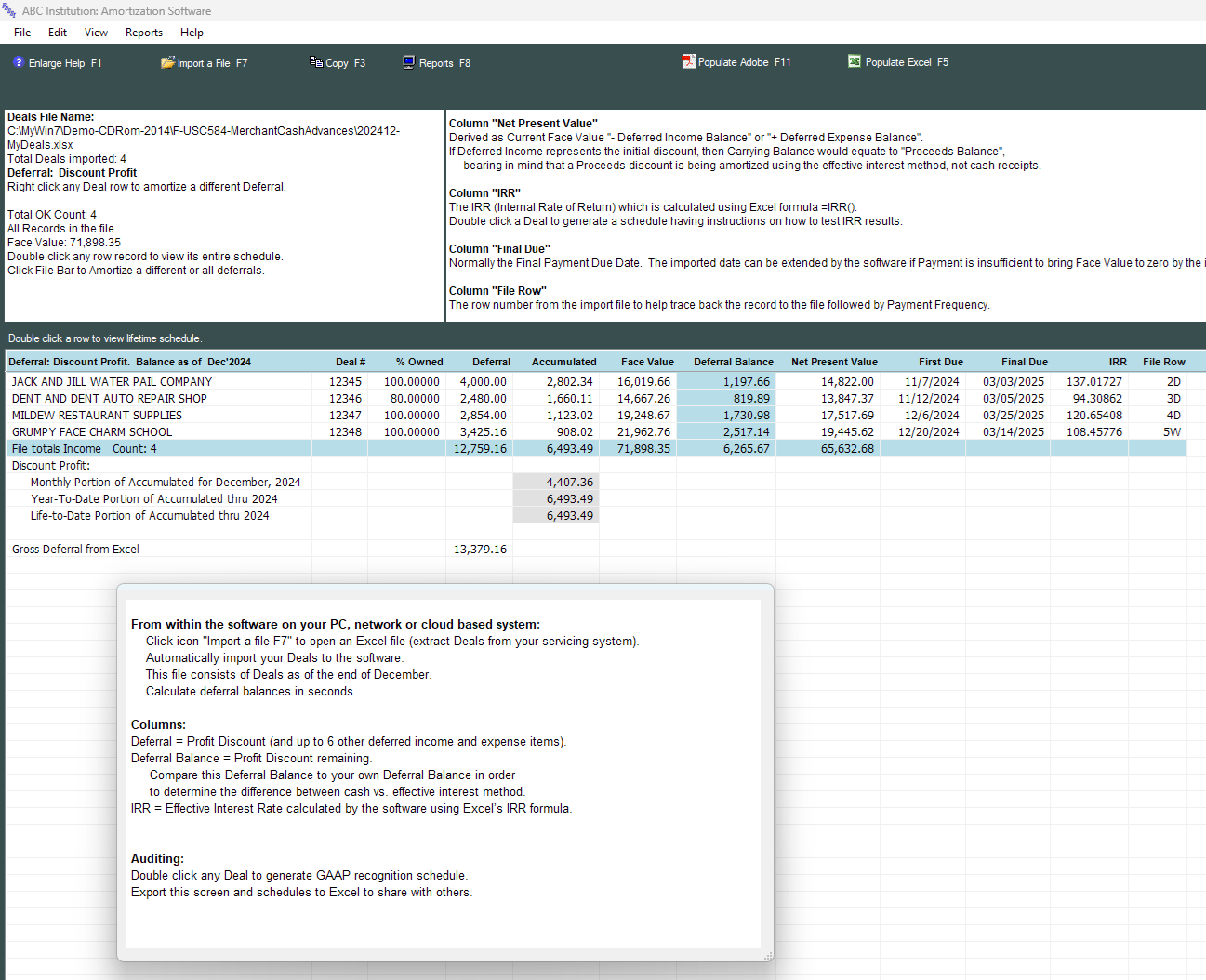

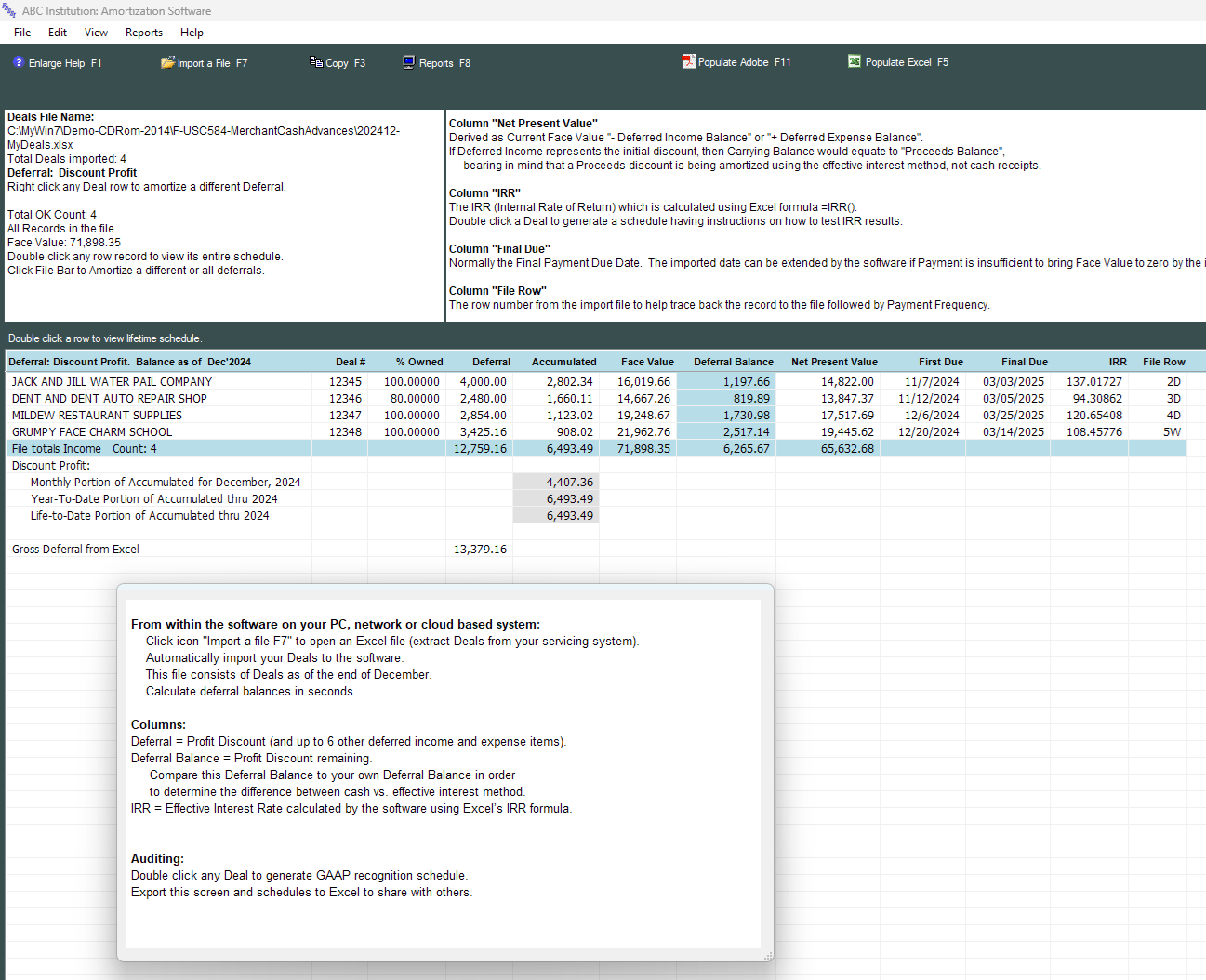

Calculate IRR Internal

Rate of Return.

Calculate NPV Net

Present Value.

Calculate deferral

balances for discounts,

bank fees, legal

expense, other fees ....

Generate totals for:

Original Discount

Accumulated income

Deferral balance

Current Face Value from the Deals File

Carrying Balance (NPV)

Verify results.

Create a recognition schedule

for any deal.

Compare software IRR

generated Deferral

Balances to Cash Basis

general ledger balances.

Post and reverse

adjustments.

|

GAAP,

FASB software for Merchant Cash

Advances with daily, weekly payments

Amortize

dozens, hundreds,

thousands of MCA deals at the same time

IRR

Effective interest rate calculation for each

record.

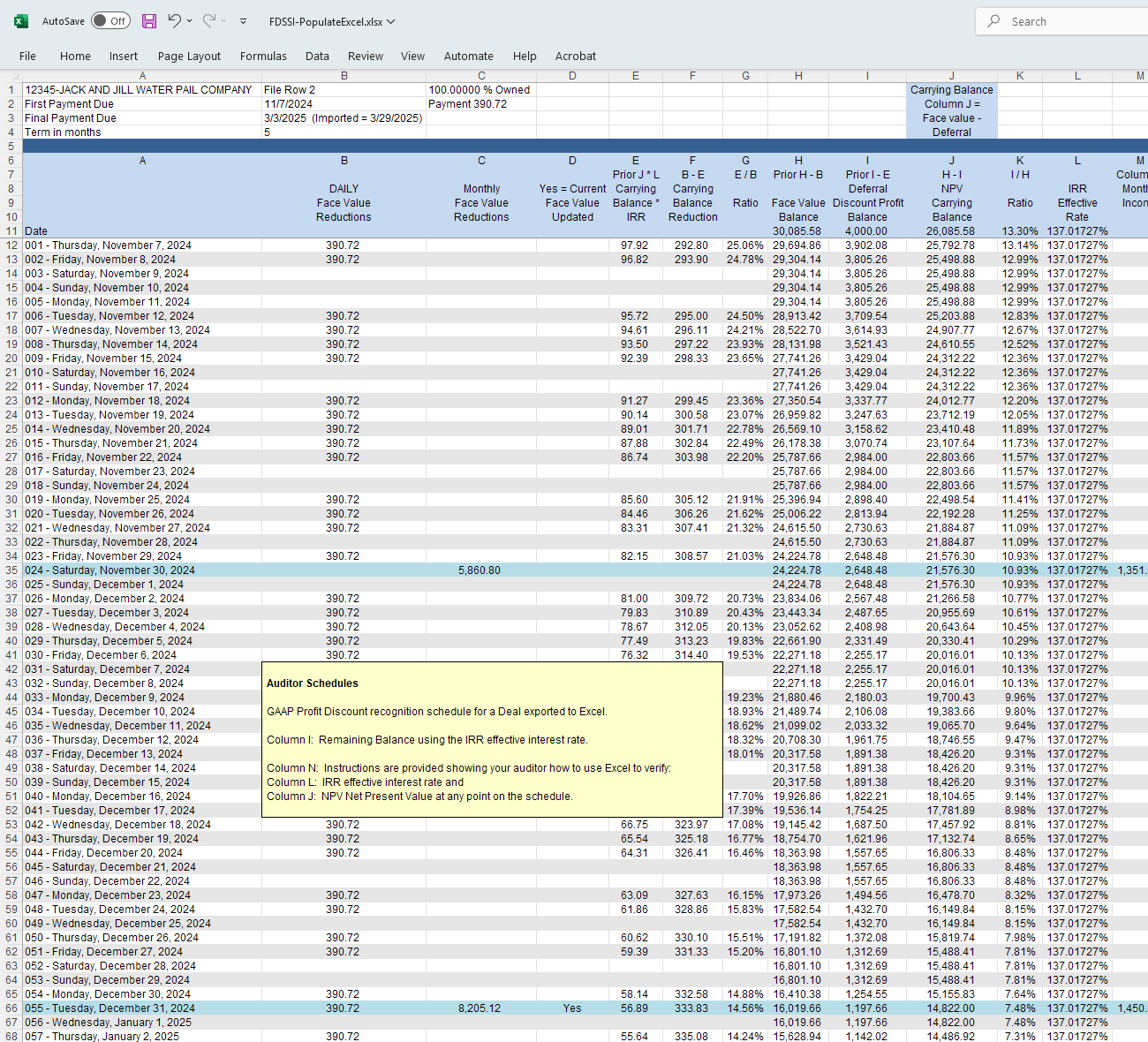

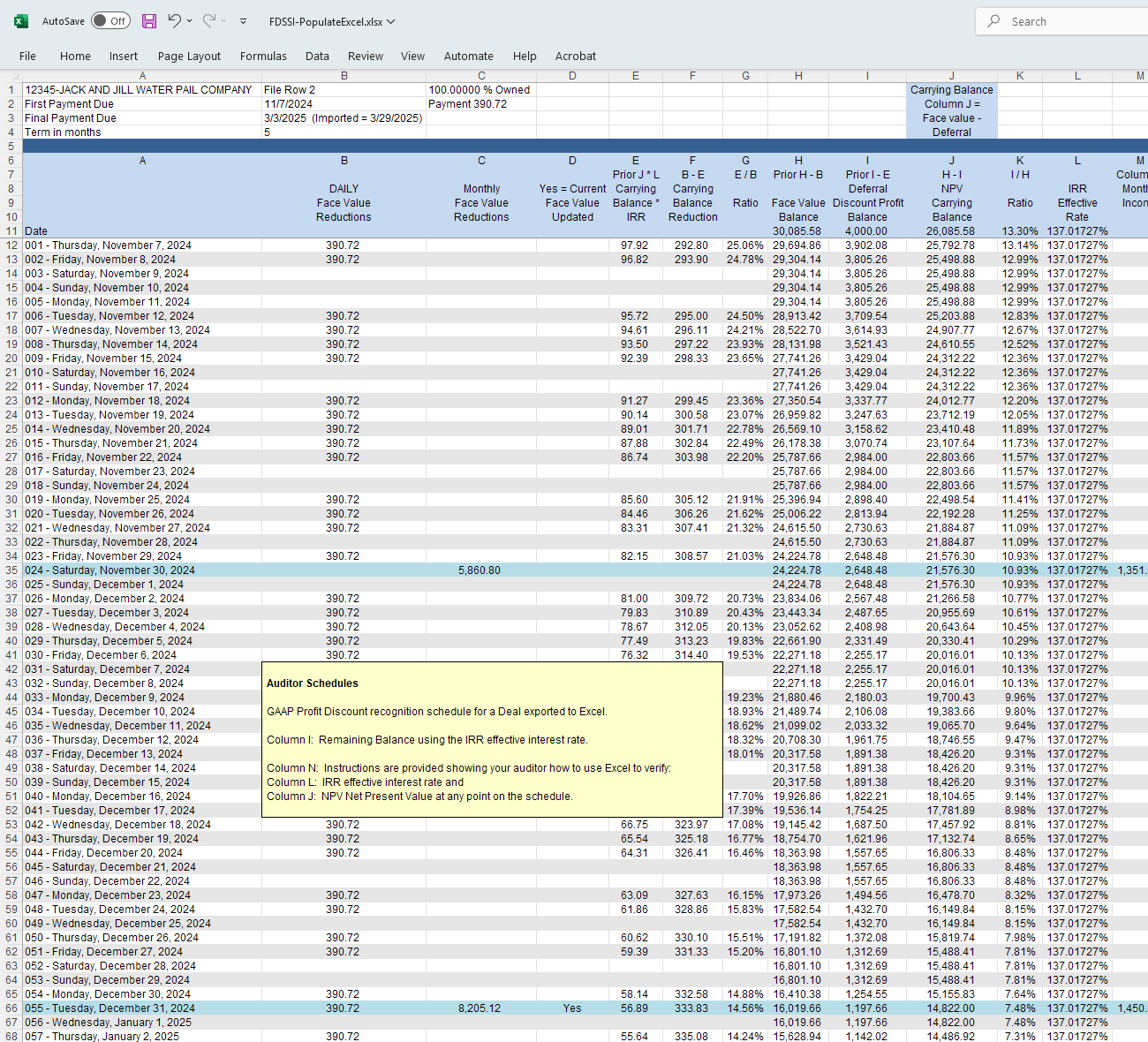

Lifetime amortization schedule

for each fee, for each record.

Deferral

% reductions for

joint venture, syndicated participations.

Freeze Schedule when a deal goes

bad.

Clear up audit exceptions with a minimum

amount of effort.

Determine what

Discount, other

Income

and Expense Balances should

be

when

using the

effective

interest method

for daily,

weekly

payments

End of month

End of year

Designed to eliminate footnote

exceptions on Financial

Statements

Calculate all MCA records at the

same time:

GAAP, FASB effective interest rates (IRR)

NPV Net Present Value (Carrying Balance, Book Value)

Discount on Proceeds Balance (Deferred Income Balance)

plus other deferred income, expense

Audit schedules

for each record:

Day-by-Day

recognition

schedule which opens in Excel

Monthly totals

Supportive documentation

IRR, NPV independent

verification in seconds

Show results to your auditor

|

|

Easy to operate

Automatically import a Deals file to the

software

Import basic information for each Deal

consisting of:

Deal number/Description

First pay date

Final pay/maturity date

Original Face Value

Discount (or other fee to be amortized as income,

expense)

Deferral % Owned if syndicated

Current Face Value

General ledger accounts if desired

Payment frequency: Daily, Weekly

Payment amount

Daily payments exclude the following

dates:

Saturday

Sunday

And the observed day for

New Year's

Martin Luther King birthday

Memorial day

July 4th

Labor day

Veteran's day

Thanksgiving

December 25th

Exception: If a Final Payment date falls on any

of the above, the Final Payment will become a Payment.

|

|

Price

Click to open and view

Price page

Request a free demo which

includes:

• A live version of the software

• Sample records

• Ability to run detail schedules

For more information,

please call

1-800-245-8444

(Florida, Eastern Time)

or

email

Support@fdssi.com

|

|

|

|