|

Scroll down for

Price Page and

free demo

Loan Packages: FASB,

GAAP

Effective interest

method software for

MBS, GNMA, LSBO, CMOs,

other pooled and packaged

loans

Premium,

discount and

other deferred

fees

amortization,

NPV calculations

for:

Purchasers and Seller Servicers

Scroll down and

View Price page

Download a free demo zip file right now

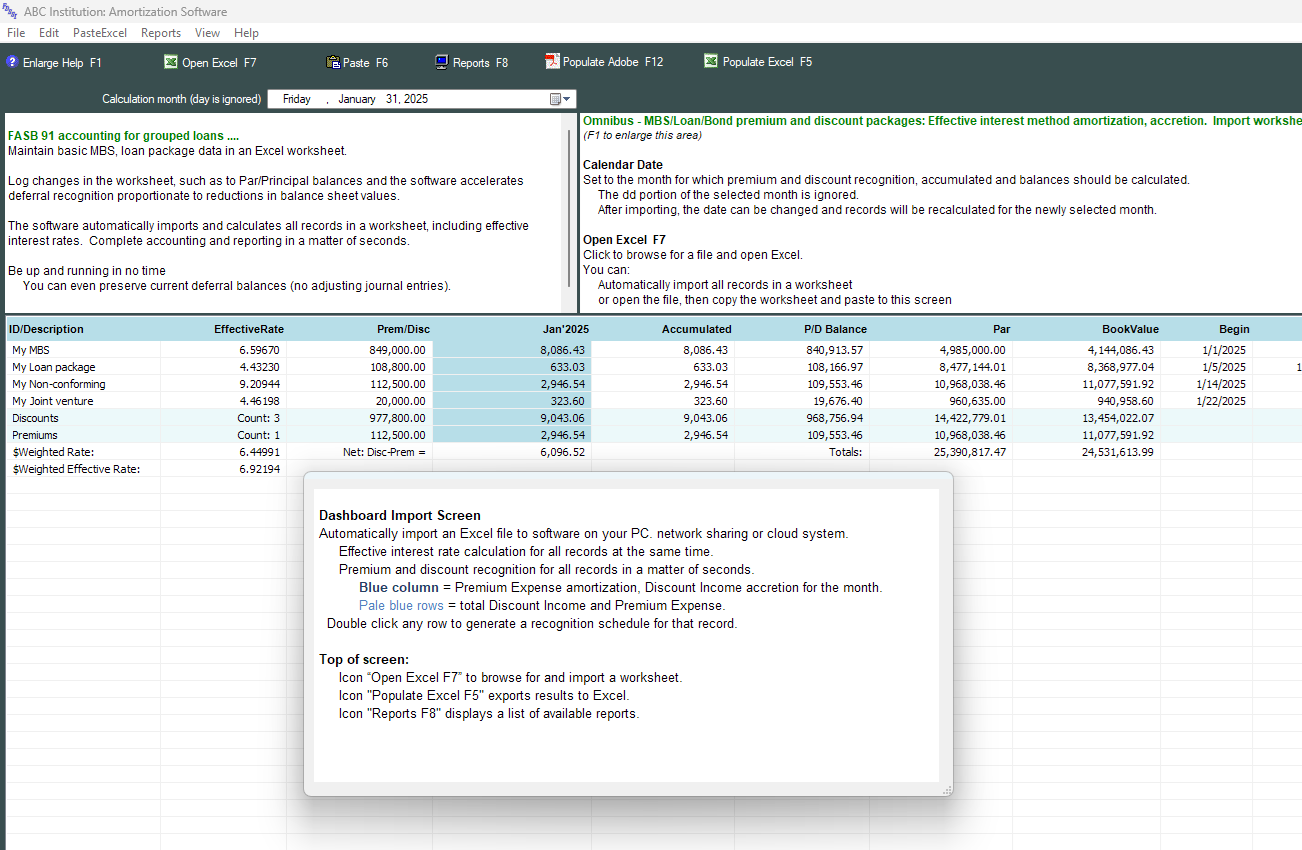

GAAP accounting amortization and reporting for dozens, hundreds

of

loan packages at the same time

• Effective

interest rate calculation

• Premium/Fee

Expense

amortization

• Discount/Fee Income accretion

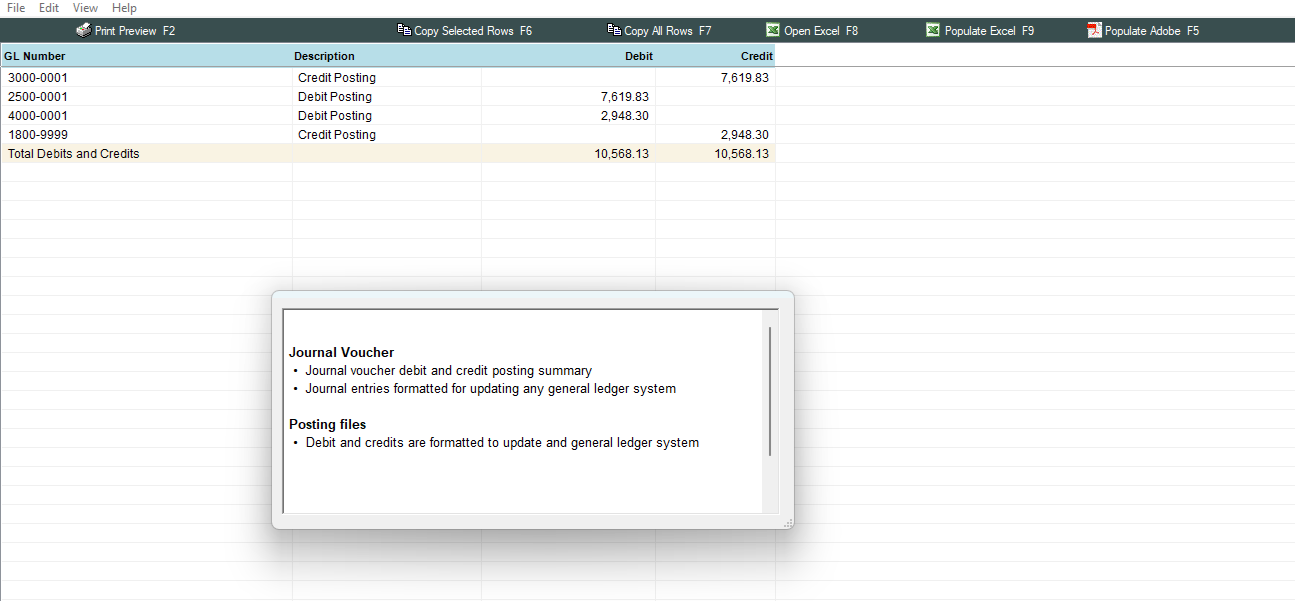

• General ledger reports and monthly postings

•

Auditing tools

• Excel file to maintain your

records and easily update principal

balances on a monthly basis

Excel file

The software comes with an Excel

template formatted to accept data

regardming your instruments.

Convert existing records and maintain

current book value.

Add new records at any time.

An ideal solution for

• MBS portfolio

• GNMAs,

Fannie Maes, ABMs, CMOs, other pools and

packaged loans

• LSBO

Participations

Whole loan packages

• Syndicated loans

• Non-conforming

individual loans

• Other premium and discount

investments with structured or

fluctuating payback

|

Your Existing

Deferral Balances

• The software can amortize premiums and

discounts from original dates.

• Or, if you have been amortizing premiums and

discounts using another procedure,

the software can preserve your

current deferral balances and amortize them

forward.

Changes during term

Initial Effective Interest Rate

calculations and amortization supporting

changes during term:

Effective interest rate recalculation and

NPV (book

value) adjustment arising from a

Decrease to Par Principal

balance - typically due to monthly

remittance

Increase to Par Principal

balance - typically due to an

advance, fulfillment

Increase to Discount Fee

Income or Premium Fee Expense

Rate change

Term/Maturity Date change

|

|

|

|