|

Hard to find GAAP recognition software • PC, laptop, work station, shared network or cloud based system • Windows 7,10,11 |

|

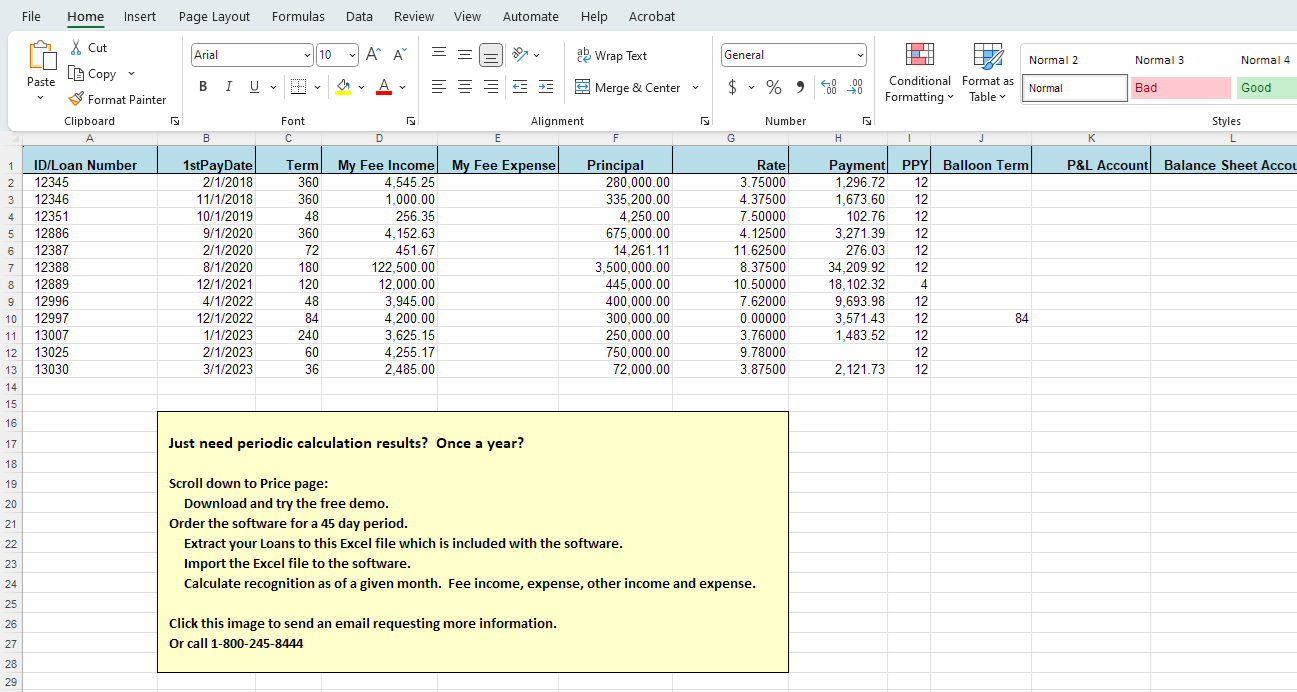

Originated and Purchased Loans FASB 91, GAAP deferred fee income and expense file amortization software Scroll down for Highlights and sample reports Price page Free demo |