Monthly

Accounting Reports for Others Software.

Ideal for

CPA client accounting services

Parent

Company with subs

Holding Company centralized

operations

Anyone

performing monthly accounting for others

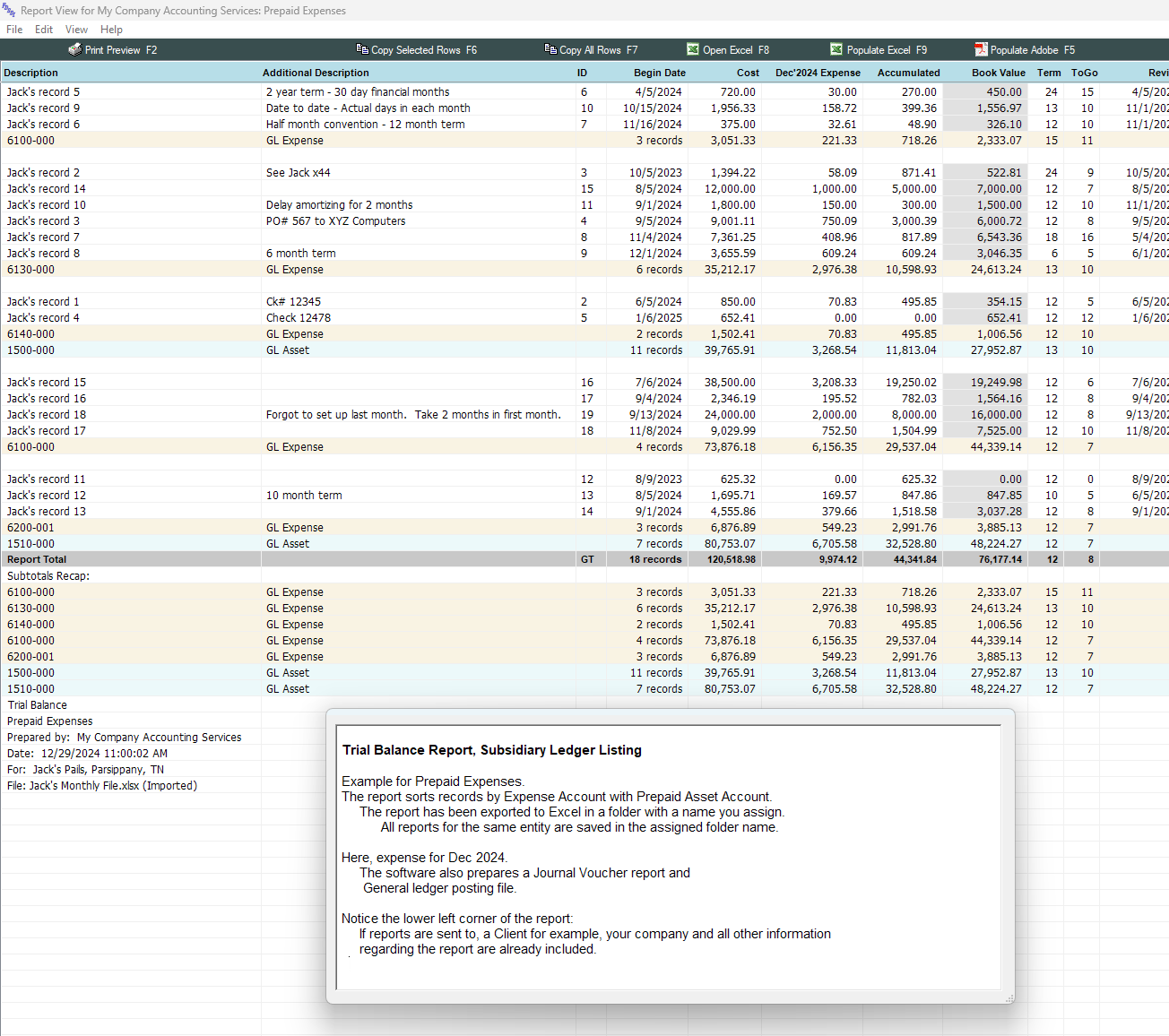

Accounting Software to

Amortize Prepaid Expenses

Also handles

Accrued Expenses including remaining payable due for

interim disbursements

Depreciate Fixed Assets, FF&E

Amortize Deferred Income

Import records from an Excel file, generate monthly recognition,

accounting reports

and posting files in a matter of

minutes.

The software

uses the

word "Client" to distinguish multiple files from

one another.

CPA, Accounting firms providing accounting

services to their clients

Parent Companies

servicing subs where a sub is the client

Holding Companies servicing various entities as clients

Your own Company for one or multiple files where you or

nother departments are clients

About Excel

files

Records can be maintained by Client and emailed each

month

Records can be maintained by your organization

They can also be your

own records stored in one or multiple Excel files.

Or span several applications, such as Prepaids

and Fixed Assets.

Minimal information required for a

record

Description

Amount

Date

Term

(in 1 - 999 months or from any date to any date)

Debit account number

Credit account number

Other features available, such as deferring

calculations to a future date. Or

"catching up" on previous monthly recognition.

Supports any chart of accounts.

Recognition

methods

Straight line, 30 day months

Terms from 1 to 999

months

Half month convention

Sum of the years digits

Recurring item

Take an amount each

month. Amount can be changed from month to

month.

From a date to a date as

30 day months

Actual days in each month

Metthod 6, do it your way.

Set each month's

recognition as a Dollar Amount, Percentage,

Units consumed, such as supplies inventory

reductions.

Set recognition to occur

monthly, quarter, semi-annually or any other

frequency.

Also use for recurring

items when future recognition is unknown.

Simply update Method 6 when amount becomes

available.

Supports

Calendar and other Fiscal periods

No monthly close-out

No annual close-out or end of year requirements

Cross from one year to the next without the need to do anything

With reports

View on screen

Send to local or network printer

Send to Excel

Send to Adobe

Existing records.

The software can

Calculate current

balances or

Preserve your current

balances

Budget projections, forecasting

Calculate expense and income amortization, with ending balances, for a future month, quarter, year.

Get accumulated and ending balances as of endind date or

include month-to-month activity.

Allocate, split, distribute income or

expense for a single record to multiple accounts

Allocate one/some/all records using the same method.

Allocate using multiple methods (percentage, branches, departments,

people count, workstation count ....)

Allocated records flow into the journal voucher and posting file for automatically updating the general ledger

|